A mortgage calculator allows you to freely estimate what your monthly housing payment might look like given your particular situation. There is a lot more to your mortgage than what most calculators offer, but this is still a great tool when you are just getting started on your home buying journey.

Not all mortgage calculators are the same. Here are some of the details you’ll look at when working with our mortgage calculator:

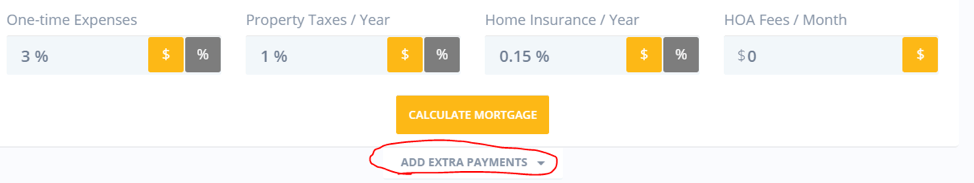

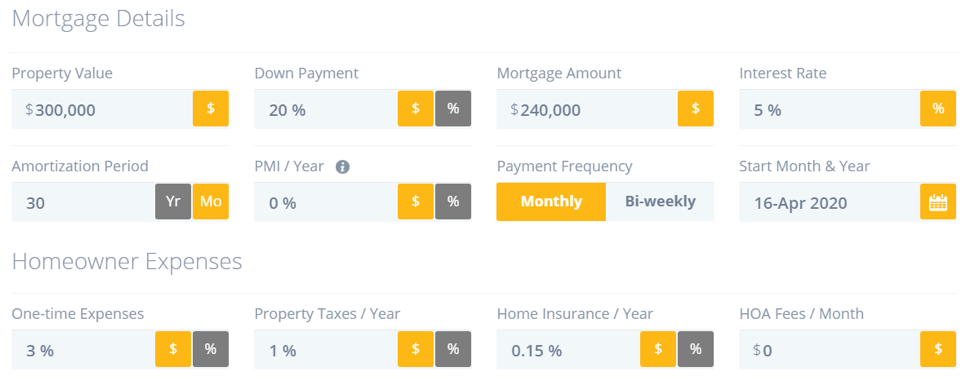

You’ll see that the calculator is broken out into two sections: Mortgage Details and Homeowner Expenses. The mortgage details section is where you will plug in your expectations for property value, down payment, interest rate, etc. The Homeowners Expenses section looks at what you expect to pay for one-time expenses (closing costs, appraisals, inspection, etc.), annual taxes, insurance and homeowners association fee (HOA).

One extra feature of our calculator is the ability to add in “Extra Payments”. If you wanted to pay off your mortgage quicker or limit the amount of interest you paid over the life of the loan, you could play with those number to get a sense of how feasible that might be for you.

How to Use A Mortgage Calculator?

The calculator’s are pretty straight forward. You will simply enter in all the information requested in the form. From there you can tweak numbers to see how changes in down payments, interest rate, etc., can impact your over mortgage payment.

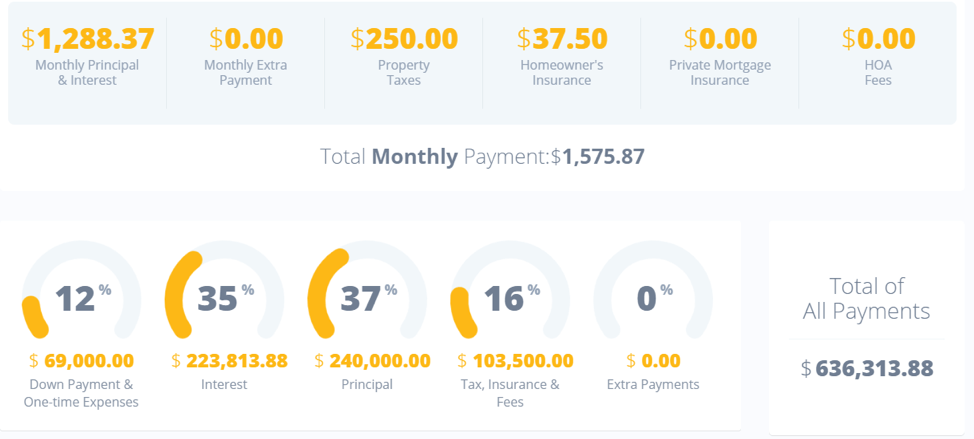

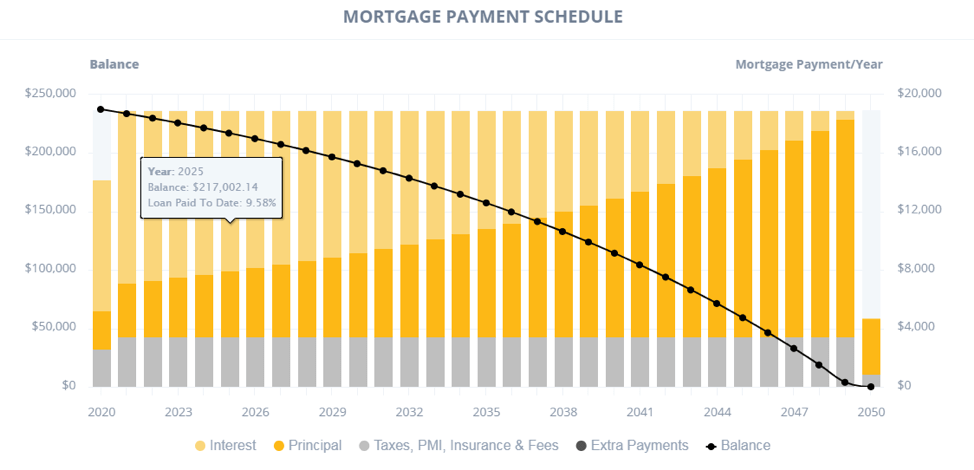

Most mortgage calculators display results in a spreadsheet of sorts which will do the trick. However, if you’re more of a visual person, our mortgage calculator gives you quick snapshots of all the key data like estimated monthly payment, taxes, insurance, total interest paid and more. We even break it down year by year so you can see how your mortgage changes over time and you can then download a PDF of your report to share with others.

Here’s some screenshots of the data you’ll be able to pull from our calculator.

How Can A Mortgage Calculator Help Me Make Decisions?

Pay off your mortgage early.

With the information provided by the mortgage calculator, you will be able to properly plan financially. Remember that by the time a fixed rate mortgage is completely paid off, the interest payments total to be much larger than the initial principal of the loan.

With the “Extra Payments” category you can determine how to shorten your loan term. You can visually see how to net larger savings by paying additional cash towards your loan’s principal with each payment monthly, yearly, quarterly, or even just one time.

Compare fixed rate vs. adjustable rate mortgage (ARM).

An ARM can be tempting to individuals considering the lower interest rate. Although it may be a great decision for some select borrowers, for others their monthly payments aren’t cut by much with the lower interest rate. The calculator will help get you visibility to this so you can make an informed decision.

Get rid of private mortgage insurance.

With our mortgage calculator you will be able to determine when equity in your home is 20%. This percentage is the threshold to reach that allows you to reach out to your lender and request to wave private mortgage insurance requirements. In other words, by seeing when you’ll reach that 20% threshold, you can plan your finances accordingly.

The Takeaway

Mortgage calculators are a great tool when you are beginning the process of buying a home. While helpful, the mortgage calculator figures are just estimates, and your actual situation might end up much different from the numbers you uncover in the calculator. Additionally, not all calculators are the same and each puts their own little spin on things. They are definitely worth playing with and discussing with your mortgage advisor as your begin the preapproval process.